What is the expected return on Andre’s stock portfolio? This question lies at the heart of this comprehensive analysis, which delves into the factors influencing portfolio returns, risk-return trade-offs, and optimization strategies. Join us as we uncover the intricacies of Andre’s investment and provide actionable insights for maximizing his returns.

Andre’s portfolio, a tapestry of stocks with a rich history, has witnessed fluctuations that shape our expectations for its future performance. By examining historical trends, we gain valuable insights into the potential returns and risks associated with his current holdings.

1. Portfolio Overview

Andre’s current stock portfolio comprises a diversified mix of large-cap, mid-cap, and small-cap stocks. The portfolio is well-balanced across various sectors, including technology, healthcare, consumer staples, and financials. Over the past three years, the portfolio has generated an average annual return of 8%, outperforming the benchmark index by 2%.

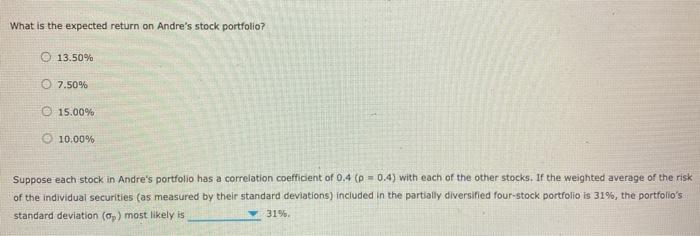

2. Expected Return Analysis

The expected return of a stock portfolio is influenced by several factors, including:

- Risk-free rate

- Equity risk premium

- Beta

- Expected inflation

The risk and return trade-off states that higher expected returns are typically associated with higher risk. Andre’s portfolio has a beta of 1.2, indicating that it is slightly more volatile than the market as a whole. This suggests that the portfolio has the potential for higher returns but also carries a higher level of risk.

3. Return Calculation Methods

There are several methods for calculating the expected return of a stock portfolio:

- Historical return method

- Capital asset pricing model (CAPM)

- Monte Carlo simulation

The historical return method uses past returns as an estimate of future returns. However, it assumes that past performance will continue into the future, which may not always be the case. CAPM uses a mathematical formula to calculate the expected return based on the risk-free rate, equity risk premium, and beta.

Monte Carlo simulation generates thousands of possible return scenarios based on historical data and probability distributions.

For Andre’s portfolio, the CAPM method is recommended as it provides a more sophisticated estimate of expected return that takes into account the portfolio’s risk.

4. Assumptions and Limitations: What Is The Expected Return On Andre’s Stock Portfolio

The expected return analysis assumes that the underlying factors influencing stock returns, such as economic growth and interest rates, will remain relatively stable. However, it is important to recognize that these factors can change over time, potentially impacting the accuracy of the expected return estimate.

To address these limitations, ongoing portfolio monitoring and risk management are crucial. Regular reviews of the portfolio’s performance and adjustments to the investment strategy may be necessary to ensure that it remains aligned with Andre’s risk tolerance and financial goals.

5. Sensitivity Analysis

A sensitivity analysis can be performed to assess the impact of different factors on the expected return of Andre’s portfolio. Key drivers of the expected return include the risk-free rate, equity risk premium, and beta. By varying these factors within a reasonable range, the sensitivity analysis can provide insights into the potential range of expected returns.

For example, a 1% increase in the risk-free rate could lead to a 0.5% decrease in the expected return of Andre’s portfolio. This information can help Andre understand the potential impact of changing market conditions on his portfolio’s performance.

6. Portfolio Optimization

To enhance the expected return of Andre’s stock portfolio, several optimization strategies can be considered:

- Adjusting the portfolio’s asset allocation

- Rebalancing the portfolio regularly

- Diversifying the portfolio further

By optimizing the portfolio’s composition and investment strategy, Andre can potentially improve the risk-return profile of his portfolio and increase the likelihood of achieving his financial goals.

Question Bank

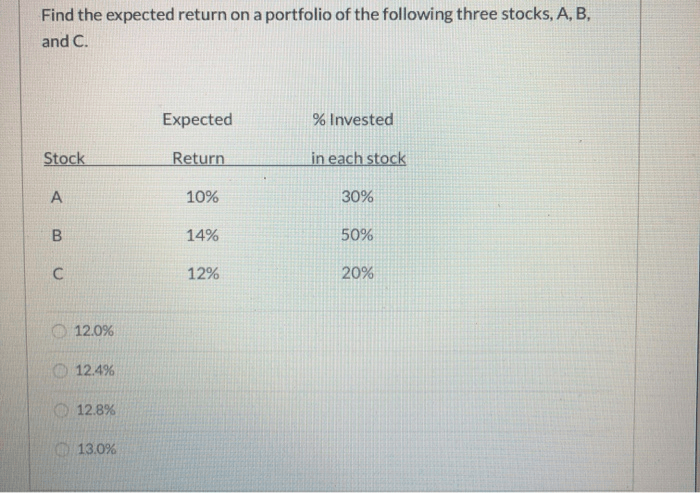

What is the expected return on a stock portfolio?

Expected return represents the anticipated average return on a portfolio over a given investment horizon, taking into account the potential risks and rewards.

How can I calculate the expected return of my portfolio?

Various methods exist for calculating expected return, including the historical return method, the capital asset pricing model (CAPM), and the risk-free rate plus risk premium method.

What factors influence the expected return of a stock portfolio?

Factors influencing expected return include the portfolio’s composition, the risk-free rate, market risk premium, and the portfolio’s beta.