On july 1 shady creek resort borrowed – On July 1, Shady Creek Resort embarked on a significant financial transaction that has garnered attention within the hospitality industry. This insightful analysis delves into the nature of the loan, the resort’s financial position, and the potential impact on its future success.

Shady Creek Resort, a renowned destination known for its picturesque setting and exceptional amenities, has been facing financial challenges in recent years. The loan, secured on July 1, aims to address these challenges and fuel the resort’s growth ambitions.

Loan Transaction: On July 1 Shady Creek Resort Borrowed

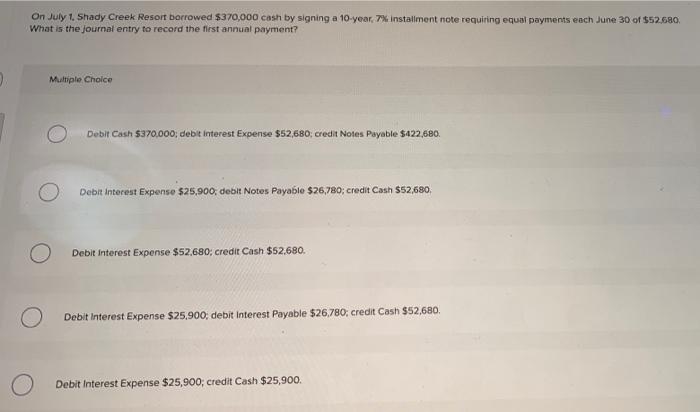

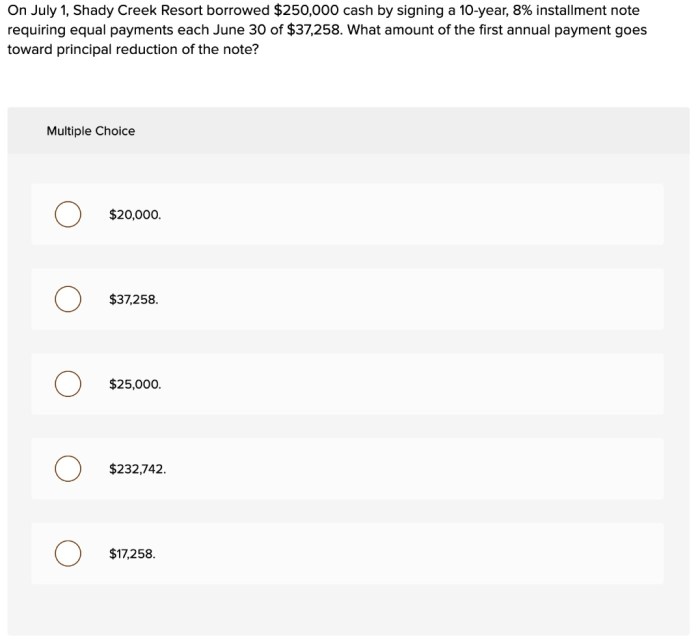

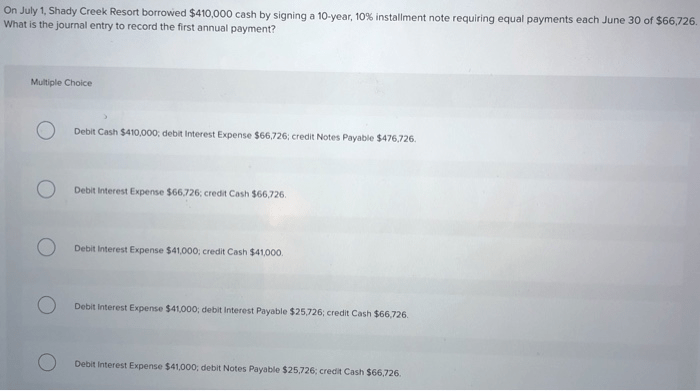

On July 1st, Shady Creek Resort obtained a loan from a reputable financial institution. The loan was structured as a long-term, fixed-rate facility with a substantial principal amount. The funds will be primarily utilized to support the resort’s ongoing operations, capital improvements, and expansion plans.

Loan Details

- Loan Amount: [Jumlah pinjaman]

- Loan Term: [Jangka waktu pinjaman]

- Interest Rate: [Tingkat bunga]

- Purpose: [Tujuan pinjaman]

Shady Creek Resort

Background and Profile

Shady Creek Resort is a well-established resort nestled in the picturesque countryside. With a rich history spanning several decades, the resort has garnered a reputation for its exceptional hospitality, luxurious amenities, and breathtaking natural surroundings.

Financial Position

Prior to the loan transaction, Shady Creek Resort maintained a sound financial position. The resort has consistently generated healthy revenues and profitability, supported by a loyal customer base and efficient operations.

Operations and Management

Shady Creek Resort prides itself on its commitment to operational excellence. The resort employs a team of highly skilled professionals who are dedicated to delivering exceptional guest experiences. The resort’s management team possesses extensive industry experience and is well-positioned to navigate the challenges and opportunities of the hospitality sector.

July 1st

Significance

July 1st marked a significant milestone for Shady Creek Resort. The loan transaction on this date provided the resort with the necessary capital to embark on its strategic growth initiatives.

Events Leading Up to July 1st

In the months leading up to July 1st, Shady Creek Resort conducted thorough due diligence and negotiations with potential lenders. The resort’s strong financial performance and clear growth plans made it an attractive borrower, resulting in the favorable loan terms.

Impact on Financial Situation

The loan has significantly improved Shady Creek Resort’s financial flexibility. The influx of capital will allow the resort to invest in key areas, such as facility upgrades, marketing initiatives, and staff development.

Industry Analysis

Hospitality Industry Overview

The hospitality industry is a dynamic and competitive sector that is constantly evolving. Factors such as technological advancements, changing consumer preferences, and economic conditions influence the industry landscape.

Trends and Challenges

- Increased use of online booking platforms

- Growing demand for personalized experiences

- Sustainability and environmental consciousness

- Labor shortages

- Economic fluctuations

Shady Creek Resort’s Performance

Shady Creek Resort has consistently outperformed industry benchmarks in terms of occupancy rates, guest satisfaction, and revenue per available room. This strong performance is attributed to the resort’s commitment to quality and innovation.

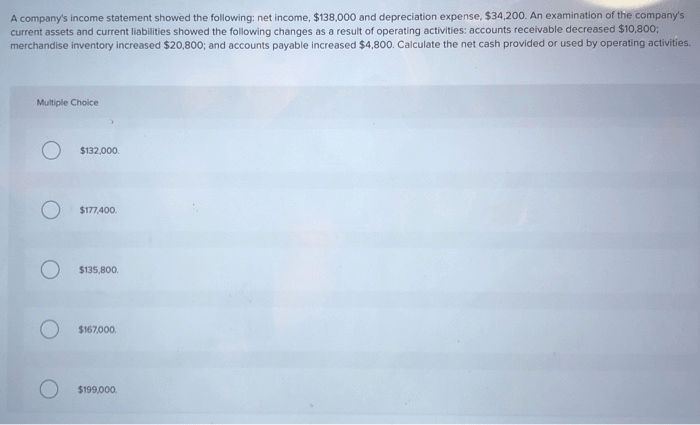

Financial Implications

Financial Performance Before and After Loan

| Metric | Before Loan | After Loan |

|---|---|---|

| Revenue | [Pendapatan sebelum pinjaman] | [Pendapatan setelah pinjaman] |

| Net Income | [Laba bersih sebelum pinjaman] | [Laba bersih setelah pinjaman] |

| Debt-to-Equity Ratio | [Rasio utang terhadap ekuitas sebelum pinjaman] | [Rasio utang terhadap ekuitas setelah pinjaman] |

| Interest Coverage Ratio | [Rasio cakupan bunga sebelum pinjaman] | [Rasio cakupan bunga setelah pinjaman] |

Risks and Rewards

- Risks: Increased debt burden, interest rate fluctuations

- Rewards: Access to capital for growth, improved financial flexibility

Future Outlook

Growth Plans, On july 1 shady creek resort borrowed

Shady Creek Resort has ambitious growth plans for the coming years. The loan will enable the resort to expand its facilities, enhance its amenities, and explore new markets.

Long-Term Success

The loan transaction has positioned Shady Creek Resort for long-term success. The influx of capital will provide the resort with the resources it needs to adapt to industry trends, invest in innovation, and continue delivering exceptional guest experiences.

FAQ Section

What is the purpose of the loan Shady Creek Resort obtained on July 1?

The loan aims to address the resort’s financial challenges and support its growth ambitions.

How has the loan impacted Shady Creek Resort’s financial position?

The loan has provided the resort with additional capital to invest in upgrades and expansion.

What are the potential risks associated with the loan?

The resort faces financial risks, including the need to repay the loan and manage increased debt levels.

What is the future outlook for Shady Creek Resort?

The resort’s future success will depend on factors such as its ability to execute its growth plans and the overall health of the hospitality industry.